Koleksi Terkait (Kata Kunci = 100 Judul)

Section B involved the details information about the respondents on the customer satisfaction towards online banking in Malaysia. The last section, Section C is contain some questions about the independent variables, which namely security and privacy, customer loyalty, service quality and convenience. Data Analysis Descriptive H1 – E-banking service quality impact customer satisfaction. H2 – Online service quality variables (reliability, usability, pleasure, privacy, speed, and control) promote customer satisfaction with e-banking. H3 – E-banking increases number of business transaction (e.g. use of ATMs) in emerging economies. H4 – inadequate information The study aimed to identify most popular electronic banking services among customers. Customer service being an integral part of banking, the study also focused on the satisfaction of customers utilising E-Banking services. Key Words: Electronic Banking, Automatic Teller Machine, Internet Banking, Mobile Banking, Level of Satisfaction

How to place an order:

I am a master student at the Banking and Accounting department, hereby declare that this dissertation entitled ‘the impact of internet banking on customer satisfaction, a case of Sulaymaniyah city, Iraq’ has been prepared myself under the guidance and supervision of H1 – E-banking service quality impact customer satisfaction. H2 – Online service quality variables (reliability, usability, pleasure, privacy, speed, and control) promote customer satisfaction with e-banking. H3 – E-banking increases number of business transaction (e.g. use of ATMs) in emerging economies. H4 – inadequate information banking leaders use to increase customer satisfaction. Data were collected through semistructured interviews from 6 bank leaders in 3 banks in Accra. Member checking confirmed the interpretation of participant data. Three themes emerged from the data analysis. The themes were customer centricity, customer relationship management, and

DETAIL KOLEKSI

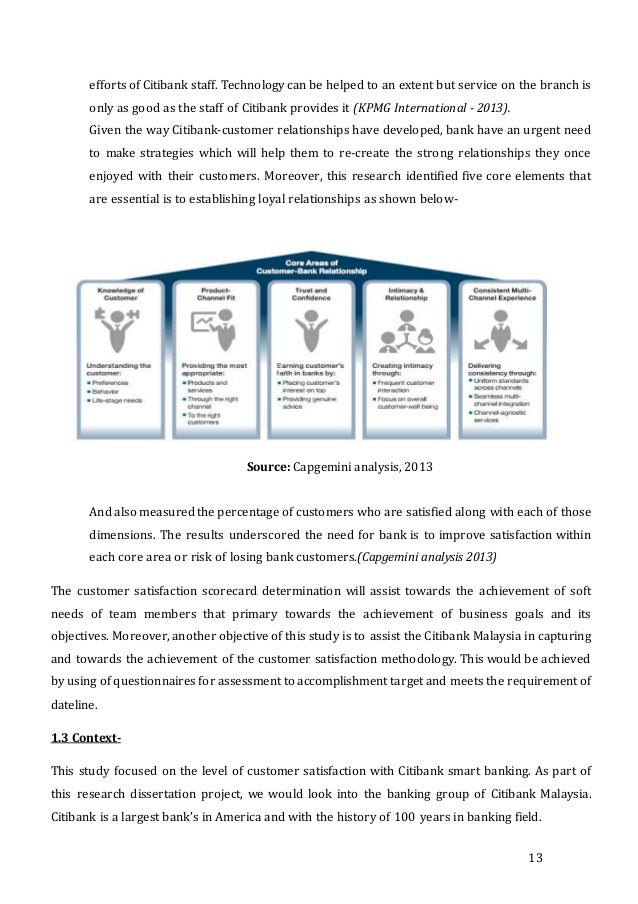

This study focuses on factors that affect customer sa tisfaction with the use of online banking services. provided by commercial banks. The American Customer Satisfaction Index H1 – E-banking service quality impact customer satisfaction. H2 – Online service quality variables (reliability, usability, pleasure, privacy, speed, and control) promote customer satisfaction with e-banking. H3 – E-banking increases number of business transaction (e.g. use of ATMs) in emerging economies. H4 – inadequate information 13/06/ · Online banking is one of the e-banking services relatively a new channel and is an umbrella term for the process by which a customer may perform banking transactions electronically without visiting a brick-and-mortar institution (Compeau & Higgins, ; Shah & Clarke, ).The fast-paced technology has affected almost all industries including banking

banking leaders use to increase customer satisfaction. Data were collected through semistructured interviews from 6 bank leaders in 3 banks in Accra. Member checking confirmed the interpretation of participant data. Three themes emerged from the data analysis. The themes were customer centricity, customer relationship management, and 13/06/ · Online banking is one of the e-banking services relatively a new channel and is an umbrella term for the process by which a customer may perform banking transactions electronically without visiting a brick-and-mortar institution (Compeau & Higgins, ; Shah & Clarke, ).The fast-paced technology has affected almost all industries including banking Section B involved the details information about the respondents on the customer satisfaction towards online banking in Malaysia. The last section, Section C is contain some questions about the independent variables, which namely security and privacy, customer loyalty, service quality and convenience. Data Analysis Descriptive

banking leaders use to increase customer satisfaction. Data were collected through semistructured interviews from 6 bank leaders in 3 banks in Accra. Member checking confirmed the interpretation of participant data. Three themes emerged from the data analysis. The themes were customer centricity, customer relationship management, and Abstract: This report is all about to find out the level of customer satisfaction regarding to online banking services and one bank limited in Bangladesh is selected as sample. To collect the data five branches from different location in Dhaka city has been visited. Almost 50 customers are asked about their satisfaction level on online banking correlation with customer satisfaction, Therefore, the internet banking has a positive impact on customer satisfaction significantly. the data has in a high level of reliability and according to the recommendations the banks should adopt and follow the internet banking service and decrease the cost and frees

No comments:

Post a Comment